Mario Volpi is head of brokerage at Novvi Properties and has worked in the property sector for 40 years in London and Dubai

Question: Will the Dubai real estate market be affected by movements in global stock markets, particularly with US President Donald Trump’s tariffs creating uncertainty? Should investors be worried? Should I wait to enter the market or will this not affect the Dubai property sector at all? JP, Dubai

Answer: Mr Trump’s strategy of increasing tariffs has two sides to it. While he is keen to address fairness of trade agreements for American goods and services, I believe, he has another agenda too, which is to create chaos to bring about instability in the short term so that banks and other governments counterbalance the threat of a recession or high inflation with potential cuts to interest rates (which will surely follow).

If this happens, the repayment of the US debt will be more manageable and there is a chance that he could come out of this smelling of roses.

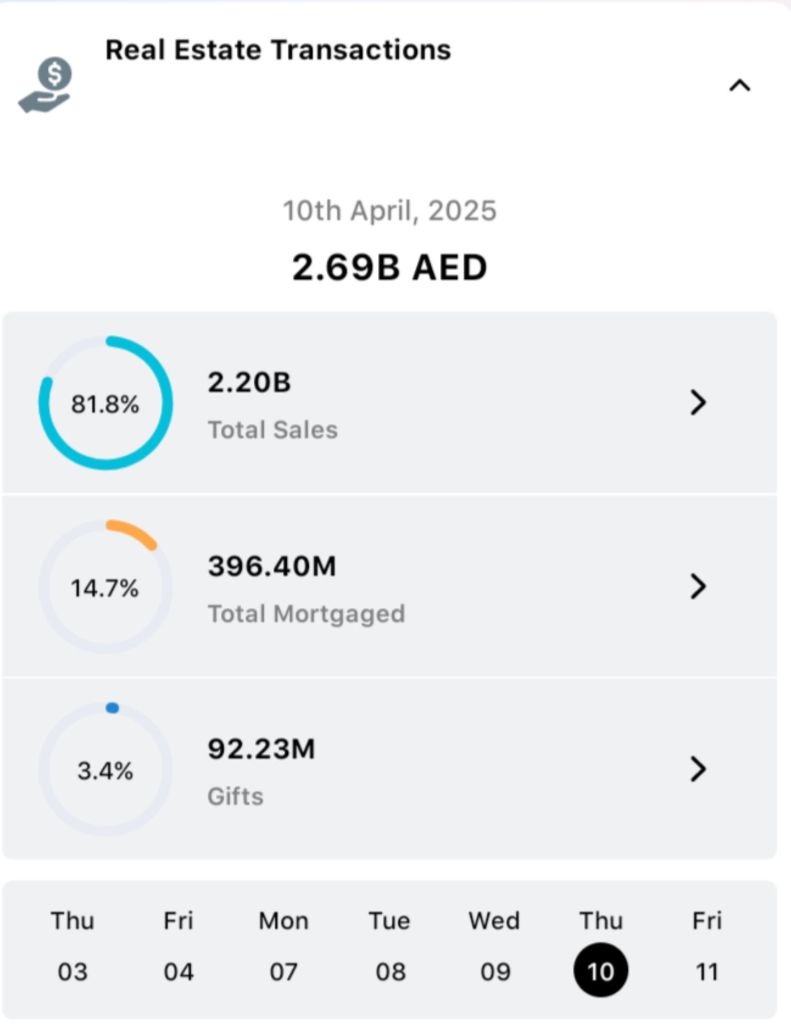

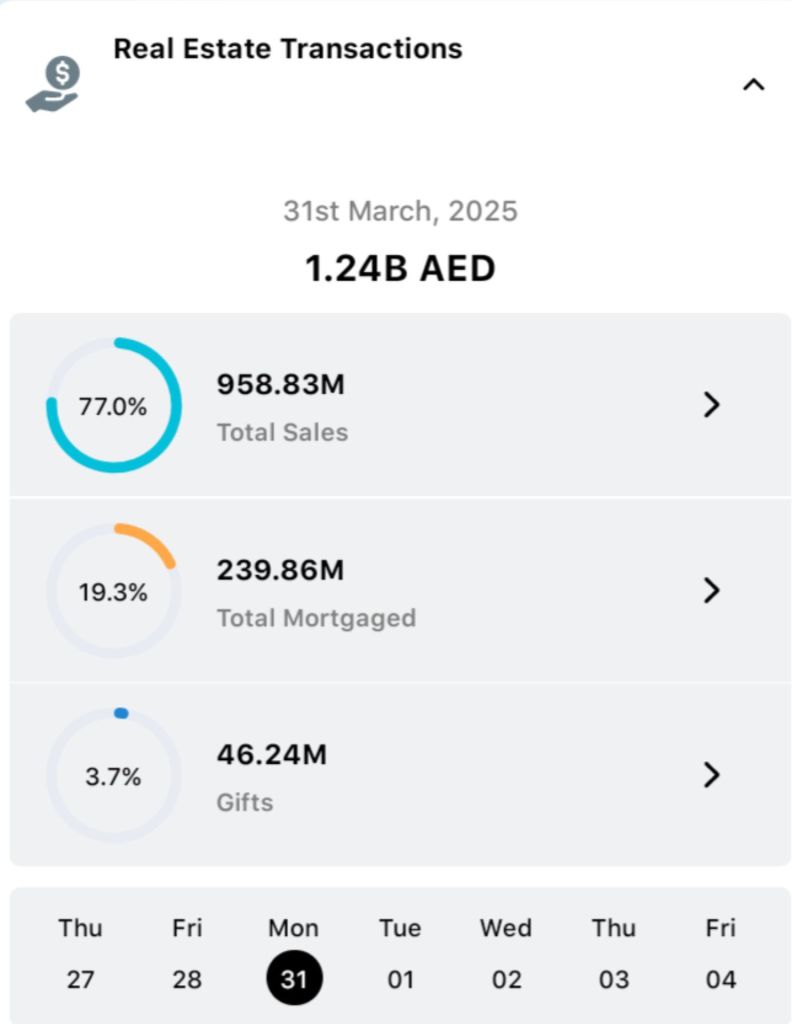

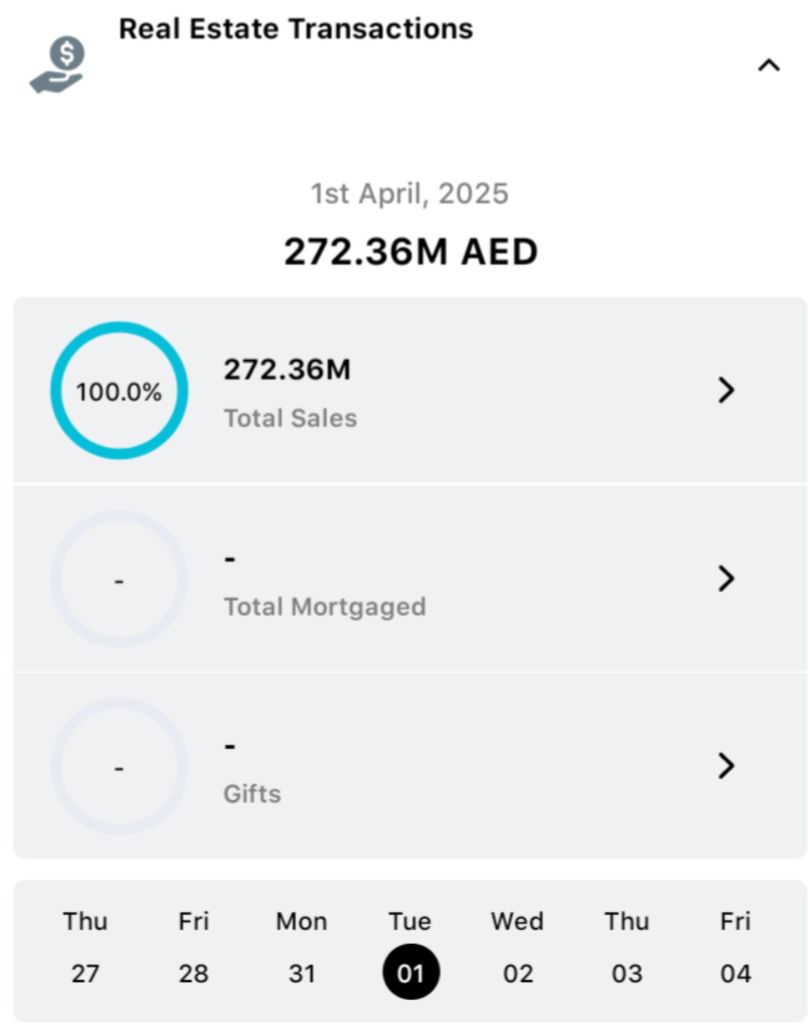

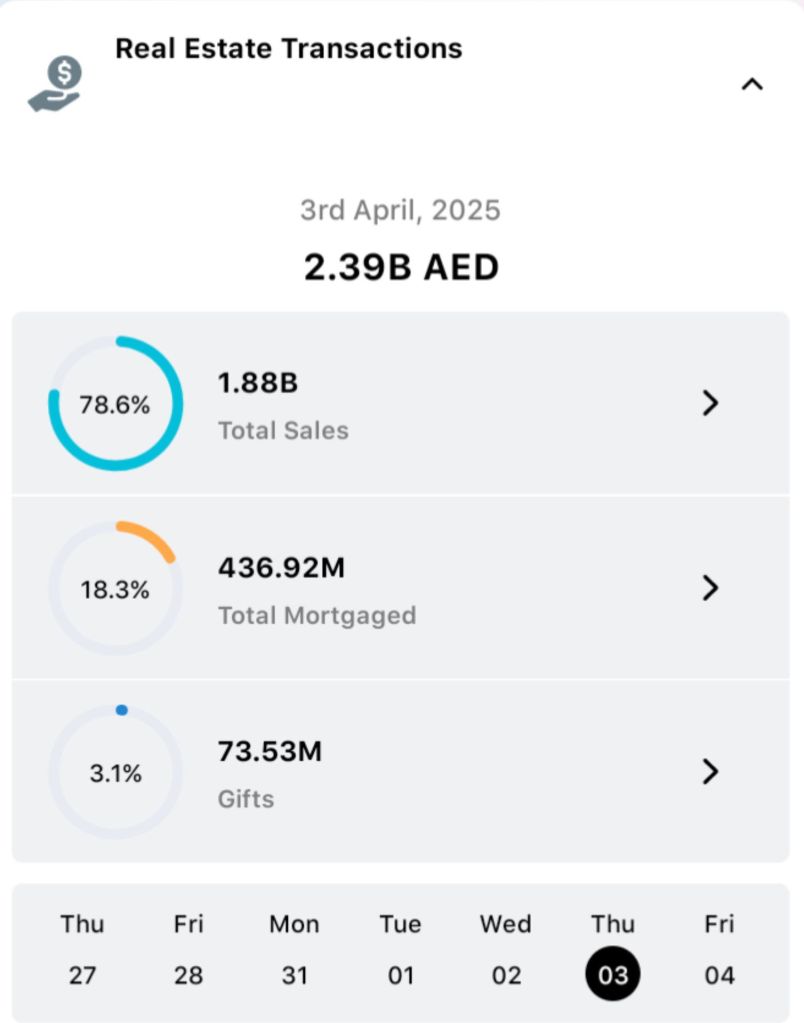

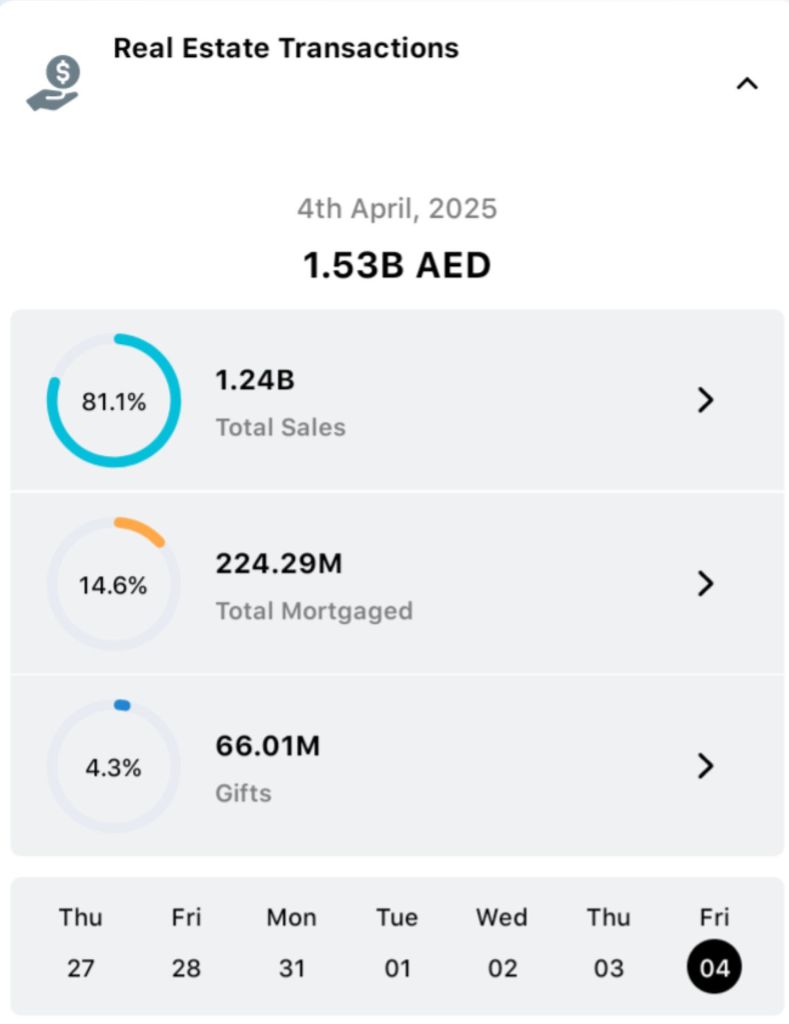

For the Dubai real estate market, the only point of note is that if interest rates reduce, this will affect mortgage rates, given that the dirham is pegged to the US dollar. This could lead to cheaper UAE mortgages, thus adding to the attraction of properties.

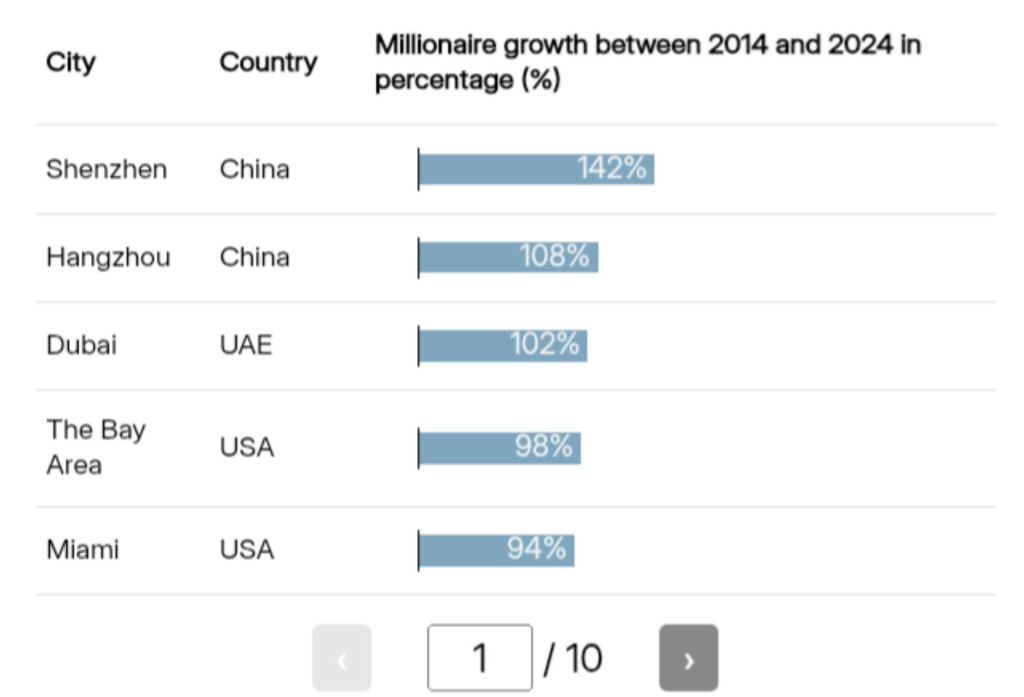

Therefore, I believe, the Dubai real estate market is in good shape, given that it is currently underpinned by proper fundamentals rather than speculation, so it should not be adversely affected by the tariff row at present. In fact, tariffs could benefit Dubai in the long run.

Q: My rental contract renews in August but I am planning to leave Dubai for good in November this year. Can I negotiate with my landlord to have a three-month extension, or will I have to move out and move into short-term accommodation? HP, Dubai

A: It is possible to negotiate with your landlord, but the likely outcome will come down to how good your professional relationship is and your powers of persuasion.

The first thing I would do is to inform your landlord, giving him/her as much notice of this as possible. You do not mention how long you have been renting the property for, so it is difficult to say how this decision may impact the landlord at this point. However, try to meet face-to-face as this may help when explaining your predicament and to agree to a date.

I would also look at the rental index to see what the renewal rental price would be, to see if the landlord is entitled to an increase. This will also help you to work out what a monthly amount will be for the extra three months.

It is preferable not to have to move twice, so be as generous with the extra monthly rate as you can, remembering that the landlord does not have to agree to this at all.

If you cannot agree on any terms or if the landlord does not allow for the extension at all, you will have to seek short-term accommodation for the remaining three months to November.

Q: I am currently in rented accommodation in a tower in Dubai but recently, water started to drip through the bathroom ceiling. Fortunately, it is dripping right into the bathtub.

I spoke to the tenants of the apartment above, but they were very unhelpful and did not give me their landlord’s details. I think there was also a language barrier. I am at a loss to where to turn to now. What should I do? PT, Dubai

A: Given the leak is dripping into your bathtub, it gives you a bit of time to resolve the issue.

My advice would be to go and speak to the building management to inform them of the situation. They will contact the landlord of the apartment above. If it is easier, you can also involve the security staff to assist you in this regard. I am sure they will try to resolve the dripping to stop any further damage.

If your property is managed, I suggest you contact the property management department of the agency you rented through and let them deal with this directly.

Philly2dubairealtor,……………….

Re-Blogged via The National